Your current location >> Press Release

Your current location >> Press Release

The stable and healthy development of the capital market is a

matter of economic and financial security. How to effectively prevent and

resolve financial risks, safeguard the construction of Shanghai international

financial center by judicial ways and maintain national financial stability?

What attempts has the Shanghai First Intermediate People¡¯s Court made as one of

the eight people¡¯s courts in China set up by the Supreme People¡¯s Court for the

trial of criminal cases involving securities and futures?

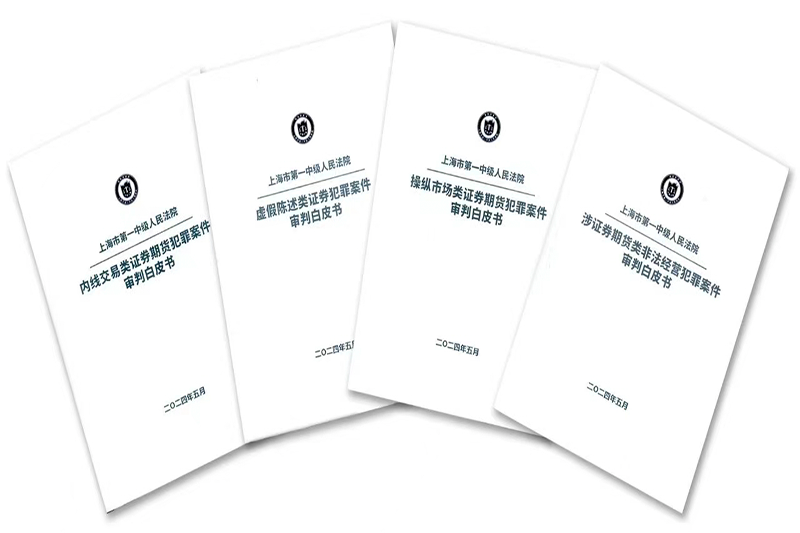

Shanghai First Intermediate People¡¯s Court held a press

conference on May 16, 2024 to release the white papers on trial of criminal

cases involving securities and futures. The four white papers are involving

crimes committed with insider trading, false statements, market manipulation of

securities and futures crimes, and illegal business operations related to

securities and futures. Shanghai First Intermediate People¡¯s Court reported at

the conference the situation of criminal cases involving securities and futures

that the court has legally adjudicated over the past decade, released 15

typical cases and put forward countermeasures and suggestions on the governance

issues of the securities and futures market that were reflected in them.

Xu Shiliang, member of the Party Leadership Group and vice

president of the Shanghai First Intermediate People¡¯s Court, briefed the

relevant situation. Representatives from Shanghai Regulatory Bureau of the

China Securities Regulatory Commission (hereinafter referred to as the ¡°Shanghai

Securities Regulatory Bureau¡±), Economic Investigation Department of the

Shanghai Public Security Bureau, First Branch of the Shanghai People¡¯s

Procuratorate, East China University of Political Science and Law, listed

companies, securities companies, and fund companies attended the press

conference.

This press conference is the 15th in the series of conferences

on ¡°Grasping Justice and Efficiency, Further Promoting the Modernization of

Shanghai Court¡¯s Work¡±.

The four White Papers presented three

issues

The White Papers show that from January 1, 2014 to December 31,

2023, the Shanghai First Intermediate People¡¯s Court and grassroots courts

within its jurisdiction have concluded 209 criminal cases involving securities

and futures, among which there are 22 cases on crimes involving insider trading

and divulging insider information, 41 cases on crimes of trading by using

undisclosed information, 5 cases on crime of fraudulent bond offering, 2 cases

on crimes of issuance of materially falsified supporting documentation, 14

cases on crime of manipulating the securities market, 1 case on crime of

manipulating the futures market, and 124 cases on crime of illegal operating

the business of securities and futures.

There are three characteristics for the type of crime mentioned

the cases: The first is that the chain-oriented characteristics of crimes are

very obvious; the second is that the means of crime are constantly updated; the

third is that the technical characteristics of crime are becoming increasingly

prominent.

The major issues presented in these cases include: Firstly, the

internal control mechanism of listed companies is unsound. For example, real

controllers of some listed companies colluded with professional stock trading

gangs and willfully planned to manipulate their own company¡¯s stock prices in

cases on crime of manipulating the securities, futures market. Secondly,

intermediary agencies misconducted their duties as gatekeepers. For example, in

some cases on crime of false statements on securities, some professional

practitioners of intermediary agencies are deficient in professional ethics,

issued audit reports that are inconsistent with the reality or issued falsified

supporting documents, and take advantage of their professional advantages to

actively provide advice for others to make false statements. Thirdly, mechanism

for coordination between administrative and criminal enforcement needs to be

improved. Taking the crime of manipulating the securities or futures market as

an example, it will generally take more than 3 years to complete the procedure

from administrative investigation to criminal trial, which leads to the delay

of criminal punishment to some extent.

Shanghai First Intermediate People¡¯s Court proposes the

following countermeasures and suggestions on the abovementioned issues:

Firstly, it is necessary to further strengthen corporate compliance. It is

necessary to lay equal stress on criminal punishment and governance, keenly

identify loopholes in corporate governance, implement a regular mechanism for

corporate compliance rectification, and promote the compliance of one industry

by promoting compliance in individual case. Secondly, it is necessary to

further increase the intensity of punishment. It is necessary to strictly

penalize crimes involving securities and futures across the entire chain and in

all aspects, strictly identify the conditions for probation, activate the

securities practicing prohibition system, and release a clear strong signal of

¡°zero tolerance¡± to the market. Thirdly, it is necessary to further facilitate

the coordination mechanism between administrative and criminal enforcement. It

is necessary to strengthen cooperation with securities regulatory authorities,

build a multi-party collaboration platform so as to realize the integration of

information sharing, case reporting, and case transfer.

The 15 typical cases published

involve the main types of current crimes involving securities and futures

It is informed at the press conference that, in the past 10

years, Shanghai First Intermediate People¡¯s Court has lawfully concluded a

batch of criminal cases involving the new types of securities and futures with

significant influence nationwide, of which 4 cases have been selected as

typical cases involving securities and futures separately or jointly published

by the Supreme People¡¯s Court.

The press conference informed the overall situation of 15

typical cases, covering the main types of current crimes involving securities

and futures. In the selection of typical cases, it is necessary to pay

attention to the overall importance of cases and adhere to the combination of

criminal trial and serving the overall of guarantee center; to pay attention to

the affinity to the people of the cases and adhere to the combination of cracking

down on crime and strengthening protection on investor; to pay attention to the

pioneering of cases and adhere to the combination of the principle of legally

prescribed punishment for a specified crime and being guided by the rules of

adjudication.

For example, in the case on crime of manipulating the

securities market by Beibadao Group, China Securities Regulatory Commission (CSRC) imposed the

highest-ever fine on Beidadao Group, which sets a record for the highest fine

imposed by the CSRC at that time. Shanghai First Intermediate People¡¯s Court

sentenced Beibadao Group to a fine of CNY 300 million for the crime of

manipulating the securities market after trial and sentenced respectively each

defendant to imprisonment of eight years and six months to two years for the

crime of manipulating the securities market. This reflects the determination of

supervision, cracking down and punishment on securities-related crimes, as well

as the implementation of the law enforcement concept of ¡°zero tolerance¡±.

For example, the case of Xian¡¯s breach of

trust and causing damage to the interests of listed company, as well as manipulation of the securities market, is the

first criminal case involving securities, from which the proceeds of criminal

fines shall be preferred to satisfy relevant civil compensation liability. It

is clearly stated in the case that for cases where investors file civil

lawsuits against losses suffered from criminal acts such as false statements, insider

trading, and market manipulation, the illegal gains and fines refunded by the

defendant cannot be turned over to the national treasury temporarily, and may

be transferred to the court that hears civil and commercial cases when

necessary, so as to be preferred to compensate investors¡¯ losses. It will

realize the effective coordination between criminal justice and civil

accountability, and effectively protect the legal rights and interests of small

and medium-sized investors.

Another example is the case of manipulating the

futures market by Yishidun and others, which is the first criminal case of manipulating the futures

market in China (the second case in the world) and involves the latest

high-frequency programmatic trading methods in the securities and futures

trading market. This case not only clarifies the application conditions of the

fallback clause for the crime of manipulating the securities or futures market

in the form of specific cases, but also show the attitude of strictly cracking

down on and no tolerance on illegal acts that harm the interests of other

compliant investors though unfair advantages obtained maliciously, which has

guiding significance for future trials of such kind of cases.

Signed a Cooperation Memorandum for

Strengthening Collaborative Governance of Violations and Crimes Involving

Securities and Futures

Shanghai First Intermediate People¡¯s Court and Shanghai

Securities Regulatory Bureau held a signing ceremony for the cooperation

memorandum of strengthening the collaborative governance of violations and

crimes involving securities and futures after the press conference. The

memorandum defines the scope of cooperation between the two parties and states

the agreement on multiple working mechanisms for joint meetings, information

sharing, case-handling coordination, enforcement interaction, integrity

supervision, expert support, law publicity, subject research and others.

Wu Jinshui, secretary of the Party Leadership Group and

president of Shanghai First Intermediate People¡¯s Court, Lin Lin, secretary of

the Party Committee and director of Shanghai Securities Regulatory Bureau, and

other relevant officials from Shanghai High People¡¯s Court, Shanghai First

Intermediate People¡¯s Court, and the Shanghai Securities Regulatory Bureau

attended the signing ceremony.

The attendees conducted discussions and exchanges on ¡°How to

strengthen joint efforts to promote the healthy development of the capital

market at the current stage¡± prior to the signing of the memorandum.

Professor Mao Lingling from East China University of Political

Science and Law noted that, it can be considered from the following aspects to

improve the three-dimensional accountability in the securities market from

administrative, civil and criminal perspective, and ensure the high-quality

development of the capital market through the construction of a comprehensive

punishment and prevention system: Firstly, it is necessary to take advantage of

the governance from the source to make the regulatory punishment measures work

like ¡°long teeth with thorns¡±, strengthen law-enforcement accountability, and

build a three-dimensional accountability system from the front end. Secondly,

it is necessary to clarify the boundaries of the legal basis for civil,

administrative and criminal liability and increase the supply of legal

provisions in the securities market that are in line with local

characteristics. Thirdly, it is necessary to further identity the issues of the

coordination between civil, administrative and criminal law enforcement.

Jiangsu, general manager of compliance and legal management

department of Orient Securities Co., Ltd. noted that, it is necessary to

conscientiously implement the central government's requirements for cracking

down on illegal activities involving securities, and effectively protect the

legal rights and interests of investors. It is necessary to consolidate and

deepen the existing achievements next, intensify judicial cooperation, and

contribute to maintaining the open, impartial and fair order of the market and

creating a good market ecology.

Zhou Yonggang, Inspector General of Changxin Asset Management

Co., Ltd. noted that, the release of the white papers has created a new

benchmark for the entire society, especially the securities and futures

industry. It is suggested that the people's court should increase the intensity

of economic punishment for loss-making crimes, promote the parallel imposition

of fines and penalties so as to increase the cost of crime and form a strong

deterrent.

Cai Guanhua, Secretary of the Board of Directors of Koal

Software Co., Ltd. noted that, Koal always adheres to the bottom line of

compliance, strictly constrains the actual controllers and controlling

shareholders from encroaching on or damaging the interests of the listed

company; Strengthen internal management to ensure the legal benefits of the

company and employees; Improve the quality of information disclosure and expand

communication channels for investors; Strengthen internal control internally to

ensure smooth exchange of information and orderly operation.

>> Chinese Version